Are you considering selling land in Texas? Choosing the right contract form is a crucial decision in the real estate transaction process. For realtors, it is mandatory to use the Texas Real Estate Commission (TREC) contract forms. However, if you are not a licensed realtor, you have other options when buying or selling land in Texas.

In this article, we will focus on the TREC unimproved property contract form and provide a step-by-step guide on how to fill it out.

Why Use the TREC Contract Forms?

When selling land in Texas it is important to use the TREC contract forms due to their fairness comprehensiveness and widespread acceptance within the real estate industry. These contract forms are not only mandatory for realtors but are also available to the general public for free.

Selling land in Texas can be a complex process but using the TREC contract forms can help simplify things for both the buyer and seller. These forms provide a fair and balanced agreement that outlines the terms and conditions of the sale ensuring that all parties are clear on their responsibilities and rights.

By using these standardized forms buyers and sellers can avoid misunderstandings and potential disputes making the transaction smoother and more efficient. Overall the TREC contract forms offer a reliable and clear framework for selling land in Texas.

When to Use the TREC Unimproved Property Contract

The TREC Unimproved Property Contract is specifically designed for properties that do not have physical buildings, additions, or fixtures on the land.

Additionally, this contract form is typically used for properties that have been platted, meaning they have a recorded Lot/Block legal description. It is essential to determine whether your property meets these criteria before using the TREC Unimproved Property Contract.

Main Differences between Unimproved Property Contract and Farm and Ranch Contract

When selling land in Texas it’s important to be aware of the differences between the Farm and Ranch Contract Form and the Unimproved Property Contract. One significant distinction is that the Farm and Ranch Contract is typically used for land with a metes and bounds legal description, which starts from a point of beginning and outlines the perimeter of the parcel using angles and distances.

Another crucial difference is that the Farm and Ranch Contract contains specific contract terms related to farms and ranches, such as fences, gates, sheds, outbuildings, and corrals. Additionally, items like portable buildings, irrigation equipment, and fuel tanks can be included in the sale under this contract.

Where to find fillable TREC forms online

Downloading the PDF forms straight from the TREC website’s contract section is the simplest approach to locate the TREC forms. They are provided as fillable, blank forms. The forms are available downloadable if you would rather fill them out by hand.

Unimproved Property Contract Form Example

Following is a brief overview of all the contract terms:

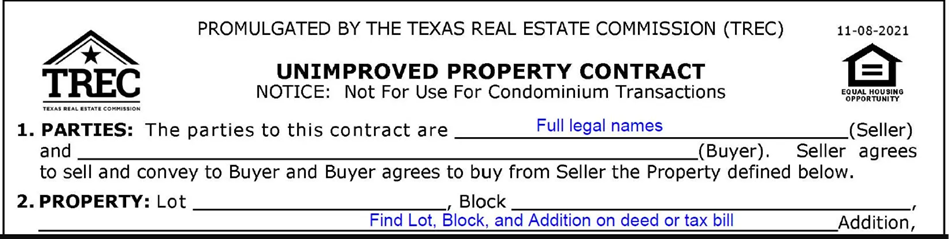

Parties

When selling land in Texas it is important to pay close attention to the first section of the Unimproved Property Contract Form. Here you will need to provide the full legal names of both the buyer and the seller.

It is essential to double-check that the names are spelled correctly and match the identification documents of both parties. This step is crucial in order to prevent any potential issues or discrepancies from arising in the future.

Property

Next, you need to provide detailed information about the property being sold, including the lot, block, and Addition. This information can be found on your property tax bill or the deed. Make sure to double-check the details to prevent any errors or confusion during the transaction.

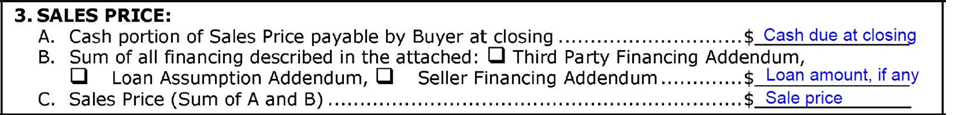

Sales Price

The Sales Price section is divided into three parts – A, B, and C. Part A represents the cash amount due at closing, Part B is the loan amount (if applicable), and Part C is the total sale price. It is essential to calculate these figures accurately to avoid any financial discrepancies later on.

Leases

If there are any natural resource leases associated with the property, this section should be filled out accordingly. It is crucial to disclose all relevant information to the buyer to ensure transparency in the transaction.

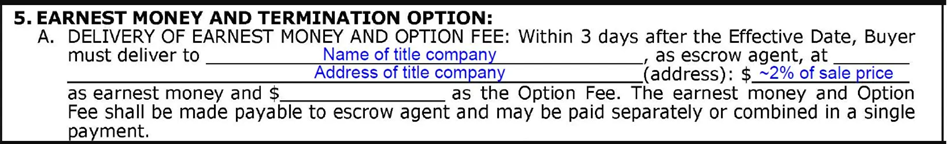

Earnest Money and Termination Option

The Earnest Money and Termination Option section outlines the amount of earnest money to be deposited and the option fee if a termination option period is included. Ensuring that the amounts are clearly stated will help avoid any confusion regarding the financial aspects of the contract.

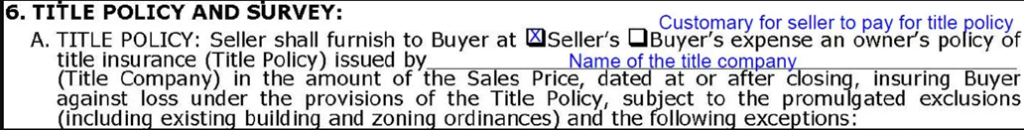

Title Policy and Survey

In Texas, it is customary for the seller to pay for the title policy and the buyer to pay for the survey if one does not already exist. This section should be completed meticulously to ensure that all necessary documentation is in order for the closing process.

Property Condition

Buyers often purchase land “as-is,” meaning that the seller is not responsible for any repairs or issues with the property. It is essential to be transparent about the condition of the property to avoid any disputes in the future.

Brokers and Sales Agents

If there is a broker or real estate agent involved in the transaction who has an ownership interest in the property, this section should be filled out accordingly. It is crucial to disclose all relevant information to ensure a smooth and transparent transaction.

Closing

The parties involved should check the title company’s availability before deciding on a closing date. It is essential to coordinate this aspect carefully to ensure that all parties are available for the closing.

Possession

The seller is responsible for delivering possession of the property to the buyer at closing. This section should specify the terms of possession to avoid any confusion or disputes between the parties.

Special Provisions

Special provisions may be included after checking the TREC contract addenda. These provisions cover specific situations that may not be addressed in the standard contract form.

Settlement and Other Expenses

This section outlines how closing costs will be split between the buyer and the seller. It is crucial to clarify these details to avoid any misunderstandings regarding financial obligations.

Prorations and Rollback Taxes

Prorated property taxes and other payments will be made until the closing date. It is essential to ensure that these prorations are calculated accurately to prevent any financial discrepancies.

Casualty

Describes what happens in case any part of the property is damaged or destroyed before the closing. This section should outline the responsibilities of both parties in such a scenario.

Default

States the consequences if either party breaches the contract. It is essential to understand the implications of defaulting on the contract to prevent any legal issues down the line.

Mediation

The buyer and seller will mediate any disagreements that they are unable to settle. This section makes sure that disputes are resolved in an impartial and fair way.

Attorney’s Fees

In case of a legal dispute, the winning party can recover their legal costs. It is crucial to understand the implications of this section to avoid any unnecessary legal expenses.

Escrow

Describes how the escrow agent (usually the title company) should handle the earnest money and what happens if the contract is terminated. This section ensures that the financial aspects of the transaction are handled correctly.

Representations

Any representations or warranties that the seller makes in the contract apply even after closing. It is essential to be truthful and accurate in all statements to prevent any legal issues post-closing.

Federal Tax Requirements

If the seller meets the definition of a foreign person, the buyer must withhold a portion of the purchase price and send it to the IRS. It is essential to understand these requirements to ensure compliance with federal regulations.

Notices

Provides full contact information, including address, phone, and email, for all parties involved in the contract. This information is essential for communication purposes throughout the transaction.

Agreement of Parties

Any addenda that will be attached to the contract should be checked off or listed in this section. It is crucial to ensure that all relevant documents are included to avoid any legal disputes.

Consult an Attorney Before Signing

Both the buyer and the seller have the option to consult an attorney before signing the contract. It is advisable to seek legal advice to ensure that all aspects of the contract are understood and agreed upon.

Common Mistakes to Avoid When Selling Land in Texas

When filling out the Texas TREC Unimproved Property Contract Form, it is essential to be thorough and accurate. Common mistakes to avoid include:

- Not providing complete and accurate property details.

- Failing to disclose any easements or restrictions on the land.

- Leaving out important contingencies that could impact the sale.

- Neglecting to date and sign the contract.

FAQs:

1. Can I use the TREC Unimproved Property Contract for properties with physical buildings?

Yes, properties without any physical buildings, extensions, or fixtures on the property are especially intended to use the TREC Unimproved Property Contract. If your property has physical buildings, you may need to consider a different contract form. It is important to consider the type of property you are selling when choosing the appropriate contract especially when selling land in Texas.

2. What happens if I make a mistake on the TREC Unimproved Property Contract?

If a mistake is made on the TREC Unimproved Property Contract when selling land in Texas it is crucial to address it promptly. Consult with a real estate attorney to understand the implications of the error and how to rectify the situation.

3. Do I need to disclose all details about the property in the contract?

Yes, it is crucial to provide accurate and complete information about the property in the contract to avoid any misunderstandings or legal issues in the future. It is recommended to double-check all details before finalizing the contract.

4. Is it necessary to have a real estate agent when using the TREC Unimproved Property Contract?

While real estate agents are not mandatory when using the TREC Unimproved Property Contract, it is advisable to seek professional guidance to ensure a smooth and successful transaction. Real estate agents can provide valuable insights and assistance throughout the selling process.

Conclusion:

Selling land in Texas can be a complex process, but using the TREC contract forms can help streamline the transaction. By following the step-by-step guide on filling out the TREC Unimproved Property Contract, you can ensure a smooth and transparent sale. Remember to consult an attorney if needed and avoid common mistakes to safeguard the transaction. With the right contract form and attention to detail, selling land in Texas can be a hassle-free experience.